Poland offers a broad range of investment incentives for both domestic and foreign entrepreneurs. The Polish law also provides a chance to take advantage of tax reliefs especially tailored for production in Poland, i.a. the Polish investment Zone, R&D Relief and IP Box. All support instruments are available on equal terms and conditions to foreign and Polish investors.

Polish Investment Zone. Significant income tax relief

The Polish Investment Zone is a tax relief instrument existing since September 2018 which replaced Special Economic Zones regime. New regulations turned Poland into one big special economic zone, where establishment or development of an enterprise, in particular production plant, often equals eligibility for an income tax exemption.

The regulations referring to the Polish Investment Zone allow to use the support in the form of an income tax exemption regardless of the location of the plant. This law intends to expand the area offering tax incentives up to almost 100% of Poland’s investment space, which is diametrical change in comparison with Special Economic Zones.

The tax exemption can be granted to businesses carrying out investment projects that include:

- setting-up of a new enterprise,

- production capacity increase,

- introduction of new products or

- fundamental change in the overall production process.

The support for investments as tax exemption is provided mainly for production activities, but it is eligible also for services sector.

The value of the tax exemption

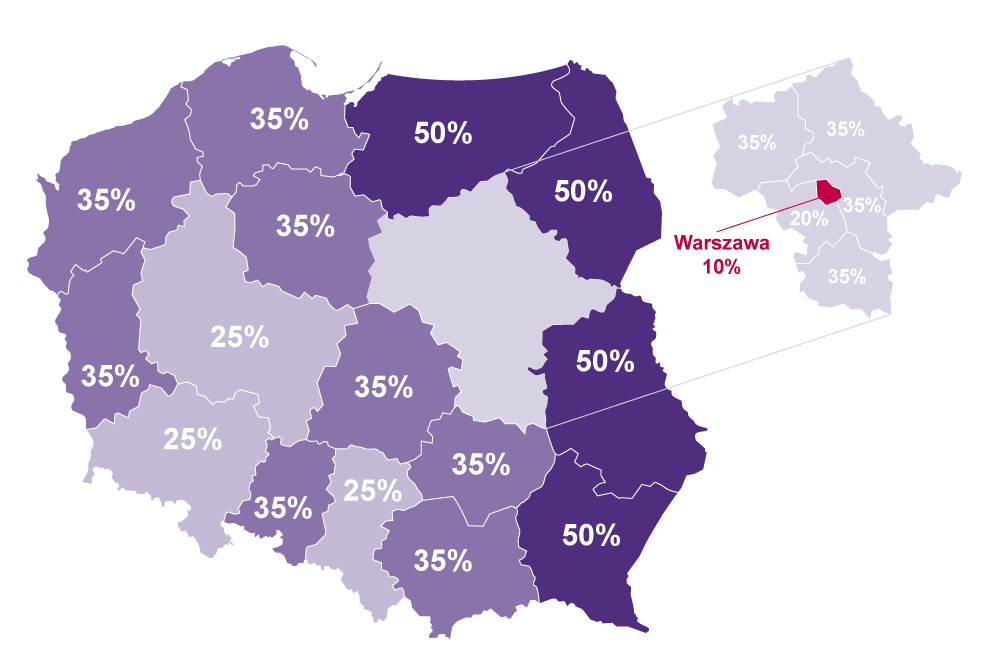

The amount of the tax exemption in CIT or PIT is calculated as the product of the intensity of regional aid and eligible costs (including e.g. real estate acquisition or rent, acquisition or improvement of fixed assets, intangible assets) or two-years labour cost of the employees hired within the new investment. The basic level of the intensity of regional aid is presented on the map below.

The level of intensity of the regional aid depends on location of the investment and size of the enterprise. The basic level of the intensity of regional aid is between 10% and 50%. Moreover, it is increased by 20% for micro and small enterprises and by 10% for medium enterprises. It means that investors can regain up to 70% of expenses in the form of income tax exemption.

Check Tax advisory services Grant Thornton

Obtaining a decision on investment support

The tax exemption is granted on the basic of an administrative decision issued by the Area Administration of each Special Economic Zone.

The decision on investment support specifies location and the subject of the activities included in the new investment, income from which is tax exempted. Activities not included in decision are coved by standard income tax.

Moreover, the decision specifies in particular:

- criteria that the taxpayer is obliged to fulfil,

- the minimum and maximum amount of eligible expenses,

- the deadline for the investment completion (incurring the minimal eligible expenses),

- validity period.

The validity of the decision on investment support may equal to 10, 12 or 15 years, depending on location of the new investment and the intensity of the regional aid. Where the aid intensity equals to:

- 50% – the decision is valid for 15 years,

- 35% – 12 years,

- Less – 10 years.

Validity period is the period the taxpayer can settle tax-exempted income. Therefore, it is at least 10 years in any given case, up to 15 years.

The new regulation allows obtaining several decisions on investment support. Settlement of tax relief from several decisions take a place in the order in which decisions are issued (tax exemption shall be settled jointly and in a chronological order).

In order to obtain the decision on investment support the investor has to fulfil two kinds of criteria, i.e.:

- quantitative criteria, which present the minimum value of eligible expenses and depends on the location of a new investment and size of the enterprise;

- qualitative criteria, which depends on the type of investment (different criteria for industrial and service investments).

The amount of possible criteria is 10. It is necessary to obtain, depending on the location, at least 4-6 points.

We prepared the eligibility verifier which is an auxiliary tool for assessing whether an enterprise may be eligible for a decision on investment support, providing an instant information on quantitative criteria.

R&D tax relief

R&D tax relief allows to recover 19% of expenses incurred with regard to Research and Development activity, in particular salaries, raw materials and other materials. Thus, these are expenses incurred anyway when conducting normal business activity.

Regardless of the fact that the expenses are tax deductible costs, they can be additionally treated as eligible costs, entitling to benefit from R&D tax relief, which in practice means the right to benefit from additional deduction and to reduce the amount of tax due.

Qualifying costs and definition of R&D works

In order to benefit from the relief it is enough to carry out development activities. It is neither required to conduct research nor have the status of an R&D centre.

Moreover, it is not required to cooperate with scientific units.

According to the Polish Income Tax Act research and development activity shall mean creative activity covering scientific research or development works, undertaken in a systematic manner with a view to increase the knowledge resources and make us of the knowledge resources to create new applications.

Development work shall mean activity of acquiring, combining, shaping and using currently available knowledge and skills, including IT tools or software, for planning production and design, and creating changed, improved or new products, processes or services, excluding activities including routine and periodic changes are made to them, even if they are improvements.

Level of allowed deductions

| Categories of eligible costs | Micro, small and medium-size entities | Big entities | R&D centres |

|---|---|---|---|

| Salaries and social securities premiums financed by the employer | 100% | 100% | 150% |

| • Materials, raw materials, tools and specialist equipment that is not a fixed asset • Expert reports, opinions, advisory services and the acquisition of research work performed by scientific units • Use of research equipment • Depreciation of fixed assets and intangible assets | 100% | 100% | 150% |

| Costs related to obtaining and/or renewing a patent for an invention, the right to protect a utility model or to register an industrial design | 100% | 100% | 150% |

Examples of development work:

- Work on software development regarding creation of new products.

- Work on new medicinal products and work on improving existing products.

- Work involving self-production, searching the market and testing new raw materials or substitutes as ingredients of products.

- Work on modification of paint and varnish formulations in order, i.a. to reduce costs and create new colour formulations.

- Work on optimizing the manufacturing process, including minimizing costs, maximizing yields, reducing labour intensity.

- Work on the possibilities of using available materials and raw materials in a new innovative way that significantly improves physico-chemical characteristics.

IP Box

The R&D tax credit is supplemented by a new tax solution effective from January 1, 2019 – the IP Box tax credit. The purpose of introducing this preference is to increase the attractiveness of conducting activities bearing the mark of innovation in Poland and to encourage entrepreneurs to boldly search for business potential in activities related to intellectual property rights. This allows taxpayers to take advantage of the preferential rate of 5% (instead of the standard rate of 19%) in relation to income that constitutes qualified intellectual property rights.

Eligible to use IP Box tax incentive are taxpayers who carry out works directly related to the production or development of intellectual property rights, including invention rights (patents), copyrights to computer programs, and protection rights on a utility model.

It is worth noting that the IP Box tax credit is supplement to the R&D tax relief. IP Box tax relief premiums generated revenues, i.e. a tax benefit is obtained by generating specific income, while R&D is a cost relief, which in practice means that a tax benefit is obtained by incurring certain expenses.

Catalogue of revenues subject to 5% tax rate

The main condition for using the IP Box relief is that the taxpayer conducts activity that qualifies under research and development. This means that the taxpayer will not be able to take advantage of the IP Box discount if the statutory definitions related to research and development activities are not met.

Although it is not required for the taxpayer to own a laboratory or operate in the IT industry, the IP Box can also be used by companies that obtain protection rights for utility models or registration rights for industrial designs. The above can be obtained from companies that deal with among others designing devices that add new functionalities to already existing products.

To take advantage of the IP Box relief, it is primarily required that the taxpayer earns income from the so-called qualified intellectual property rights; the catalogue of these rights is as follows:

1) a patent;

2) a protection right for a utility model;

3) a right under the registration of an industrial pattern;

4) a right under the registration of an integrated circuit topography;

5) an additional protection right for a patent for a therapeutic product or a plant protection product;

6) a right under the registration of a therapeutic product and a veterinary therapeutic product admitted to trading;

7) authors rights to a computer program

– being subject to legal protection under provisions of separate Acts or ratified international agreements to which the Republic of Poland is a party and other international agreements to which the European Union is a party, the object of protection of which has been created, developed or improved by a taxpayer as part of research and development activity conducted by him/her.

The income (loss) from the qualified intellectual property is the income earned (loss incurred) by the taxpayer in a tax year:

1) from fees or dues resulting from a license contract that relates to a qualified intellectual property right;

2) from the sale of a qualified property right;

3) from a qualified intellectual property right included in the selling price of a product or service;

4) from indemnities for the infringement of the rights resulting from a qualified intellectual property right if it was obtained in dispute settlement proceedings, including judicial proceedings or arbitration proceedings.

Disclosing revenue subject to 5% in annual tax return

The IP Box tax credit is an annual credit, meaning that the tax benefit is obtained only after the end of the tax year upon submission of the tax return in which the amount subject to preferential taxation with a 5% rate is shown. This amount is then reimbursed in the form of the difference between the full tax advances paid during the tax year calculated using the standard 19% rate and the tax actually payable tax after applying the 5% tax rate.

The above means that in order to use the IP Box relief, in addition to a number of formal conditions, you must also submit an attachment to the annual tax return, which will result in part of the income subject to a 5% tax rate.

Contact us to discuss how we can help with Tax Incentives in Poland

Małgorzata Samborska, Leader of the Warsaw Office, Tax Advisor

T: +48 609 452 377 M: malgorzata.samborska@pl.gt.comMichał Rodak, Tax Advisor

M +48 661 538 594, E michal.rodak@pl.gt.com

Check Foreign Investor Navigator Grant Thornton