Recently, the government adopted next year’s state budget assumptions, including the projected average remuneration in the national economy. The government also published its proposed statutory minimum monthly pay for 2021 and the minimum hourly rate. How will this impact on employers and taxpayers, not only in terms of social security contributions?

Summary:

- What is the average remuneration in the national economy projected by the government.

- What minimum monthly pay and minimum hourly rates will have to paid to workers.

- How ZUS contributions will be affected by the statutory pay increase next year.

- What other payroll parameters will be affected by the increase of the minimum pay rates.

In the draft budget for 2021 adopted on 28 July 2020, the Council of Ministers assumed that the projected average gross monthly remuneration in the national economy in 2021 will amount to PLN 5452 (which is up by 4.3% from this year’s PLN 5227, significantly slowing down the upward trend of the past few years). In practice, this means gross PLN 225 more per month compared to the projected average monthly remuneration in 2020.

At the same time, the Government Information Centre CIR announced (also on 28 July) the government proposal regarding the statutory minimum monthly pay and the minimum hourly rate for 2021, which is to go up by PLN 200 YOY, sparking strong opposition from employers. What are the plans in detail?

Minimum monthly pay and hourly rate

The minimum monthly pay proposed by the government for 2021 is to amount to gross PLN 2800, which is PLN 84 more than previously declared by the government (i.e. PLN 2716; but still less than promised before the pandemic, i.e. gross PLN 3000). This means that the minimum monthly pay will go up by PLN 200 from this year’s PLN 2600.

Next year’s minimum hourly rate is to amount to gross PLN 18.30, up from the PLN 17 applicable in 2020.

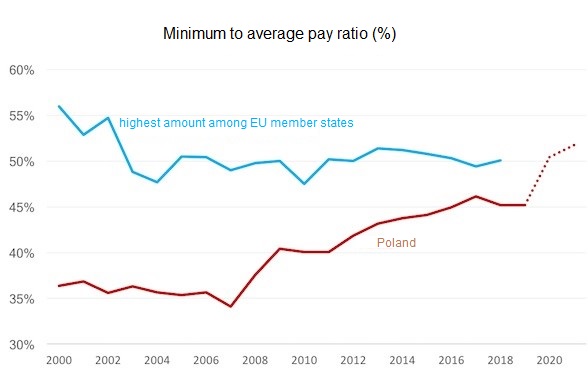

This means that the minimum pay will go up by 7.7 per cent YOY. According to CIR, “as a result, in 2021 the minimum monthly pay will account for 53.2 per cent of the projected average monthly remuneration in the national economy for 2021”.

How much will businesses have to pay to ZUS in 2021?

Seen as the assessment basis for social security contributions amounts to 60% of the projected average monthly remuneration, businesses may expect a noticeable increase in their public dues next year. The amount of the health insurance contribution (which is announced only at the beginning of the new calendar year) is not yet known (and is the most costly contribution for businesses – amounting to PLN 362.34 this year). But we can already determine the amounts of social insurance contributions. According to the calculations by Grant Thornton’s HR & payroll specialists, the monthly ZUS contributions towards social insurance in 2021 will amount to PLN 1115.15. This is PLN 46.01 more every month (up from PLN 1069.14), and PLN 552.12 more annually.

ZUS contributions from new businesses

For new businesses, eligible for preferential ZUS rates, monthly ZUS contributions are assessed based on the minimum (not average) monthly remuneration (indexed annually) at 30% of the assessment basis. If next year’s minimum monthly pay remains at the level proposed by the government, new entrepreneurs will pay social insurance contributions amounting not to PLN 246.80 (which they pay today, without the contribution to the Labour Fund), but PLN 265.78 – which is PLN 18.98 more per month (and PLN 227.76 more per year).

How else will the higher minimum pay impact on employers?

Monika Smulewicz, labour law expert and partner at Grant Thornton, explains that a change in minimum pay has a direct effect not only on ZUS social insurance contributions, but also on a whole range of other pay parameters. These include:

- amount of remuneration exempt from deductions (assessment does not include payments towards employee capital plans PPK),

- night work allowance,

- minimum monthly assessment basis for sickness allowance,

- minimum assessment basis for contributions towards retirement and disability insurance for people on unpaid parental leave who had been employed on a full-time basis prior to the leave,

- minimum amount of revenue from which Labour Fund contributions are paid,

- maximum remuneration paid under school leaver internship contract (amounting to double the minimum monthly pay),

- compensation for breaching the principles of equal treatment in employment (which may not be less than the minimum monthly pay),

- remuneration for downtime due to reasons attributable to the employer (which likewise may not be less than the minimum monthly pay),

- compensation for workplace harassment (likewise),

- remuneration in the month during which the employee does not fulfil their work duties due to the work schedule (likewise),

- maximum amount of severance paid out pursuant to the collective redundancy law provisions (i.e. “on detailed rules of terminating employment due to reasons not attributable to employees”. OJ 2018 item 1969 of 15/10/2018 – no more than 15 times the minimum pay).

Monika Smulewicz concludes: Minimum pay is a key parameter in the assessment of a great number of payroll elements and has a direct impact on increasing payroll costs, not only in the context of base pay.

What do employers and experts have to say about the government’s plans?

The government’s proposals regarding a considerable increase of the minimum pay rates have obviously been met with criticism from the business community. For instance, the Employers of Poland (Pracodawcy RP) see them as a “very risky experiment”, predicting it will jeopardize approx. 63% of jobs in micro- and small businesses (i.e. more than 1.5 million workers).

Analysts, too, have been quite vocal in their comments. Among them, one measured position comes from Ignacy Morawski, head of SpotData analytic centre, who said

“Poland is becoming a European leader in terms of minimum pay”. Is that good? Morawski summarises government’s ideas thus: “I believe that the attempts aimed at bridging income inequality constitute a civilisational change, which will progress for many years in the majority of the developed economies. And this progress will be achieved by experiment, because analyses cannot tell us exactly which boundaries should not be crossed. And the thing about experiments is that sometimes they work, and then they don’t.”

source: SpotData.pl

Is the government proposal of minimum pay rates bound to be passed?

The government proposals regarding the minimum monthly pay and the minimum hourly rate were presented to the Social Dialogue Council on 31 July 2020. The Council brings together the representatives of the business community, trade unions and the government. Each party should agree and put forward their proposals, which are then the starting point of negotiations. Every year, talks on this topic can continue even well into the autumn. If the parties fail to reach an understanding, the government unilaterally determines the amounts of the following year’s minimum pay rates, by 15 September at the latest (which was the case for instance last year).